Image by M.Maslany

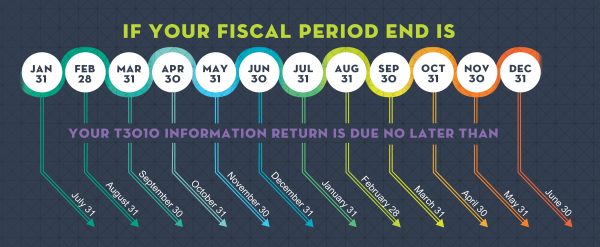

If you are a registered charity, as you likely know, your organization needs to file a Registered Charity Information Return every year. The CRA has recently created a graphic to demonstrate when your Return is due, depending on your year end:

A complete Return is not just form T3010, but also includes various attachments including financial statements, list of directors and trustees and various other schedules, if and as applicable (qualified donees, activities outside of Canada, compensation, confidential data, gifts in kind, political activities and more).

The CRA publishes guides & forms (note: they may differ depending on your fiscal year end) to help you fill out your Return, but we wanted to highlight some key tips we’ve gathered from reading between the lines and also attending a recent CRA audit of a charity. This was not a ‘targeted’ audit, just a simple check up, but it did reveal some insights about how the CRA may interpret parts of the Return and how you can ensure your Return is as iron clad as possible.

1) Think of paper or electronic trails like road maps

Every step and turn or decision you make needs to be documented – like you were crafting your own retraceable map of your decisions and actions. Paper trails don’t have to be in paper but if they aren’t make sure you’re keeping pdfs and screen captures of any steps that wouldn’t otherwise generate a document. As an example, if you’re determining the value of an in kind donation of a piece of art and you look at the artist’s website to determine their typical retail value of a particular piece, screenshot that and save it. Think of school when the teacher made you ‘show your work’ so they know how you got to a conclusion. Even if it’s obvious, show the steps you took and keep the records.

2) Know that CRMs and the CRA don’t necessarily think alike

The CRM you use may not have been developed with CRA charities compliance in mind; therefore don’t rely exclusively on your CRM records for documentation. Whatever process it is you’re fulfilling, make sure you double check with CRA’s guidelines to see if there are components missing from your CRM’s functions that you’ll need to supplement. As an example, if you issue an electronic/email donation receipt to a donor and they lose it and request that you re-send it, it is likely not sufficient to just re-send it. You need to ensure that there is an indication that the one you’re re-issuing (which will have the same number on it as the original) is marked duplicate. If the receipt was a paper hard copy mailed and there was an error (e.g. wrong address), the CRA prefers that you wait for that original to be mailed back to you before you re-issue a corrected receipt … see above re: paper trail!

3) Do look an in kind gift horse in the mouth

We’re not saying to be unappreciative toward the donor, but you do need to be critical when examining and determining the value of the gift made. The CRA has guidance on how and when to issue charitable receipts for goods (not for services!). If you receive a gift that’s valued – or alleged to be valued – at $1000 or more needs to be receive an independent appraisal to verify the amount a charitable tax receipt is issued for. For gifts valued less than that, records (screen shots, catalogue excerpts, receipts for gift certificates, etc) need to be kept electronically or in paper to justify the amount issued as a receipt.

4) Keep with the program

As a charity, you have charitable purposes that have been approved by the CRA. These purposes (or objects) define the scope of activities that can be engaged in by your organization, and, subject to limited exceptions, limit how the organization can spend its resources (money and time, including volunteer time). It’s important to keep track of how your activities and other allocations of resources are in furtherance of one or more of your approved charitable purposes. There shouldn’t be another major program or project you’re involved in that’s not demonstrably related to the furtherance of your purposes. For more information, see CRA guidance here.

5) Know where your political activity begins and ends

There is a lot that one could say about defining and tracking political activities; the CRA has extensive resources on this subject. Our main point is for your organization to have a system by which you can show where and why an activity that may be political started and where it ended. This should include who worked on it (including volunteers) and a detailed way of tracking time and expenses. One place to look when figuring out where your political activities start is your strategic plan. Likely (hopefully) all your work has a tie into your strategic plan and so if some of your work is political in nature, you may be able to trace it to an objective in your strategic plan, or a work plan that results therefrom.

6) When in doubt, ask and get your answer in writing

If you’re unsure about anything or how a rule or question applies to your charity, don’t hesitate to ask the CRA (or, failing that, your lawyer). We recommend you get your answer in writing, if possible, so that you have a record of the advice you were given. Keep in mind that the written record may have to be in letter form, so give yourself ample time to ask advice and receive a written letter.

Good luck with your charity information return this year!

This is general information. It is not legal advice and it is not meant to be tailored to your organization. Please inquire with our lawyer, Rachel Forbes, directly if you have specific questions about this or other aspects of your Charity Information Return.